Heloc mortgage strategy calculator

You take out a new mortgage with a new mortgage rate and terms and use it to pay off your old one. A home equity loan a home equity line of credit HELOC or cash-out refinancing.

Mortgage Payoff Calculator With Line Of Credit

Home Equity Loan Calculator HELOC Calculator.

. 1 min read Sep 10 2022. 1 in 5 19 say they borrowed more on their HELOC than initially intended 13 borrowed less. If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced.

You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. No age requirement and must have at least 20 equity in the home. What is a HELOC.

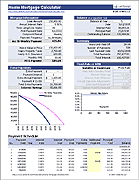

Its best to use an amortization calculator to understand how your payments break down over the life of your mortgage. On the flip side fixed mortgage rates are not tied to the prime rate. Results provided by this calculator are intended for Illustrative purposes only and the accuracy is not guaranteed.

HELOC Mortgage Payoff Limits. Check out the webs best free mortgage calculator to save money on your home loan today. Most HELOCs operate on a 30-year term with a draw period ranging from 10 to 15 years and a repayment period ranging from.

A first lien HELOC is a line of credit and mortgage in one. Rates displayed are the as low as rates for purchase loans and refinances. This rate offer is effective 09132022 and subject to change.

Aside from making extra payments mortgage refinancing is another strategy to shorten your term. Since variable mortgage rates and home equity lines of credit HELOCs are directly tied to a lenders prime rate when the BoC hikes its policy interest rate variable mortgage rates and HELOC rates then also go up. One of the most popular arrangements is a Shared Equity Financing Agreement SEFA.

Paying extra affords you the flexibility to contribute any amount. Then make adjustments to your employer W-4 form if necessary to more closely match your 2022 federal tax liability. Todays mortgage rates.

This strategy involves tapping into your current homes equity and carrying multiple mortgages at once. Homeowners have three main options for unlocking their home equity. Like a mortgage a HELOC is secured by the equity in your home.

Borrowers should start looking for refinancing at least a year of 6 months before the balloon mortgage ends. Investing in a home is a good strategy for a parent who needs to be paid back and possibly make some money on the house in the long run. A shorter repayment period.

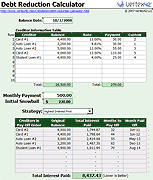

This is a viable strategy that can help you repay your lender without defaulting on your mortgage. Not all borrowers will benefit from a HELOC down. If you cannot commit to 700 in extra payments such as a 15-year fixed loan you can still prepay your mortgage in increments of 50 or 100.

You can use a HELOC for just about anything including paying off all or part of your remaining mortgage balance. This calculator does not assure the availability of or your eligibility for any specific product offered by Citizens Bank or its affiliates nor does the calculator predict or guarantee the actual rate. HELOCs carry some special risks and limitations.

Rates are based on creditworthiness loan-to-value LTV occupancy and loan purpose so your rate and terms may differ. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Lenders typically limit the combined total of HELOC and existing mortgage to 80 of the homes appraised value.

Your actual results may vary. The average home equity as a percentage of home value for those without a mortgage but with a HELOC. Second position HELOC.

It is also a good strategy if the parent wants to invest an amount that exceeds the annual gift tax. It usually comes in a line of credit paid to you by a lender. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances claimed.

Our calculator includes amoritization tables bi-weekly savings. Mortgage rate deals for week ending Sept. Instead they are directly influenced by 5-year bond yields.

A HELOC is not necessarily a second mortgage. One strategy to grow your earnings is to open several CDs that mature at different times. This is an ideal strategy if you want to reduce interest charges and shorten your payment term by a few months up to several years.

Refinancing allows you to pay off your large balance in installments giving you enough time to reduce it gradually. Fixed mortgage rates are a historically popular option with 5-year fixed mortgage rates accounting for 60 of all mortgage requests made on Ratehubca in 2021. Must be at least 62 and own the home outright or have a small mortgage balance Home equity loan.

One benefit of a HELOC is the long loan term. They often work by replacing your existing mortgage taking over as a first mortgage while also working like a checking account. While people might find it confusing this is not at all a second mortgage which requires monthly payments.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. A HELOC is often second position because there is another mortgage on the property at the time. This means that you can hold your mortgage with one bank and get a HELOC with another bank.

To use the calculator enter your mortgage amount principal. Refinancing can allow you to get a lower mortgage rate pay off your home loan faster change from an adjustable- to a fixed-rate loan or borrow against your home equity through a cash-out. Taking a reverse mortgage is a popular financial strategy that helps generate more income during retirement.

Top offers from lenders Mortgage rates have been volatile but there are deals to be had. 15-Year Vs 30-Year Mortgage Calculator Mortgage Refinance Calculator Mortgage APR Calculator. A mortgage refinance is basically trading in your old home loan for a new one.

Instead a reverse mortgage is the opposite of a traditional mortgage. The benefit of a fixed mortgage is that you are protected against interest rate fluctuations so your regular payments stay constant over the duration of your term regardless of what. No resources for tax strategy or planning.

The Mortgage Reports covers mortgage rates mortgage news mortgage strategy and real estate. A first or second mortgage is used to refer to the loans claim position. But other than that it can help you obtain lower interest rates.

Unlike a mortgage a HELOC offers flexibility because you can access your line of credit and pay back what you use just like a credit card. The amount of home equity withdrawn by borrowers via HELOCs in 2018. To begin with only homeowners with lots of equity compared to the homes value can use this strategy.

![]()

Mortgage Payoff Calculator With Line Of Credit

Velocity Banking Heloc Checking Acct It Works Proof

Mortgage Payoff Calculator With Line Of Credit

Heloc Calculator How To Get To Your Payoff Date Youtube

![]()

Home Equity Line Of Credit Calculator Heloc Qualifier

Mortgage Payoff Calculator With Line Of Credit

The Internet S 1 1st Lien Heloc Calculator Try Today

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Heloc To Pay Off Mortgage Youtube

Early Mortgage Payoff Calculator Heloc Strategy Youtube

Mortgage Payoff Calculator With Line Of Credit

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

How To Avoid Pmi Know Your Options U S Mortgage Calculator

Early Mortgage Payoff Calculator Heloc Strategy Youtube

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

![]()

The Internet S 1 1st Lien Heloc Calculator Try Today

What Can Your Heloc Home Equity Line Of Credit Do For You